PART 3: HO CHI MINH CITY – Emerging city market or bubble risk?

10/10/2017NOW, WHAT ABOUT HO CHI MINH CITY?

As we have already learned, Ho Chi Minh City is a relatively young property market. The majority of existing buildings is at least five to ten years old and therefore cannot compete with new supply that modern buyers favour in terms of quality, design and amenities. Meanwhile, the demand for high quality real estate here is continuing to expand. At the same time, the changing consumer characteristics, such as the creation of single household due to children living independently or divorce, also drive demand for real estate. Whilst a majority of this demand will affect the affordable housing segment there are, by extension, stimulating effects on the mid- and high-end segment for those that upgrade from one tier to the next above.

Photo 4. Ho Chi Minh City, Vietnam

Arguably, one could conclude that in the affordable segment you will likely find a higher percentage of owner-occupiers than in the high-end or luxury segment given that the risk-reward profile of affordable homes may not attract investors on a grand scale.

From a foreign investor’s perspective, one would likely exclude mid-end and affordable homes from the considerations based on the above assumption. That means, our examination will focus on the high-end and luxury segment, the spectrum that has seen the highest amount of foreign purchasers.

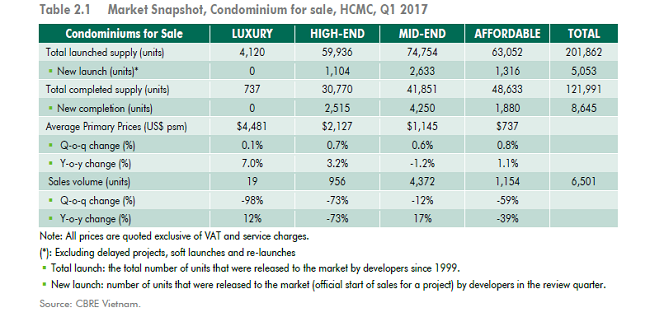

Table 2: Market Snapshot, Condominium for sale, HCMC, Q1 2017

Now, examining the supply in the high-end segment, a recent CBRE report states that there will be a total supply of nearly 60,000 completed apartment units by end of 2018. According to the same CBRE research, their agency’s buyer profiles show that between 40-66% of purchasers are buy-to-let investors. If we now estimate conservatively that only 40% of all purchasers in the high-end segment are buy-to-let investors that would mean a total supply of apartments for rent in Ho Chi Minh City of around 24,000 units. Recent statistics from the Labour Department showed that approximately 48,000 foreigners were eligible to work in Ho Chi Minh City and the surrounding provinces, referred to as the metropolitan area of Ho Chi Minh City. Ho Chi Minh City itself recorded a number around 21,000. Considering a reasonable amount of local renters at the lower end of the spectrum between USD500-1,500, that shows a balanced supply-and-demand outlook for the years to come.

The big losers of this are the older buildings that are seeing increasing disadvantages in quality, design and location with more and more upscale residential communities to choose from. However, in districts where the high-end segment is seeing a vast supply, the rental prices might slip across the board and adjust to more reasonable levels which will also affect rental yields for unit owners.

If one compares this to the situation in the luxury segment, matters are much different. According to CBRE total supply of luxury apartments for sale in Ho Chi Minh City, a metropolis of over 10 million inhabitants, is just over 4,000 units, with only 700 units completed. This reflects actual market sentiment from those expats that have high budgets to spend on accommodation and scramble to find high quality housing. This is a serious consideration for overseas investors as one would typically purchase properties that are easier to rent out. If that same property is also showing great prospects for capital appreciation then the equation almost becomes a ‘no-brainer’.

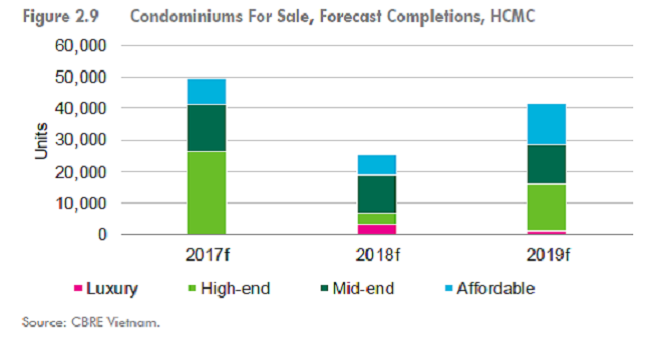

Figure 3: Condominium for sale, Forecast Completion, HCMC

Over the past two years, we have witnessed that overseas buyers purchase mostly properties in CBD areas or close to public transport networks but, more importantly, they prefer to purchase in the luxury segment rather than mid- or high-end market. The reason they cite is usually the past experiences of purchasing an apartment in an emerging property market and having made great gains with it. These investors look at Ho Chi Minh City today and understand that prime property will not be available at fifty percent of the cost in even Bangkok or a fraction of any other developed cities in Asia for much longer.

The Ho Chi Minh City property market remains active, albeit visibly slower than two years earlier but developers are reacting by slowing down launches as well. That will help to further consolidate the competitive mid- and high-end segments. For the remainder of 2017, more luxury projects will be launched that will match the expectations of foreign buyers and attract a higher percentage of overseas investors. Square meter prices in the CBD areas are rapidly increasing from an average of USD4,500 last year closer to USD6,000 and above for 2017 and 2018. Therefore, yield expectations in the luxury segment may also have to be adjusted as higher purchasing cost may not necessarily translate into rising rental rates. However, this will be offset by the exponentially growing property values of CBD apartments as land in city center locations is becoming increasingly difficult to acquire.

INDOCHINA PROPERTIES is the premier real estate brokerage for luxury homes and investment properties in Vietnam. With years of experience in sales of high-end real estate all over Vietnam, we provide you with crucial insights and market knowledge to make your real estate investment in Vietnam a smooth process.

If you are interested in Vietnam real estate investment, please contact Indochina Properties consultants at info@indochina-properties.com or hotline +84 901 535 550

Related post: HO CHI MINH CITY – Emerging city market or bubble risk? (Part 2)

Tiếng Việt

Tiếng Việt 한국어

한국어 +84 905 871 234

+84 905 871 234

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)